Financing a Movement With Up to $1 Billion in One Year

The next logical step, in fact the ONLY logical step, is to GET THE MONEY to roll out big when you have an idea that generates revenue.

Started with very little starting capital. But they all found the money they needed to grow their business, one way or another because they made it the most important thing in their life.

This post doesn't contain theory, but proven methods only.

Media is owned and controlled by media companies that buy up other media companies. Why aren't we doing that?

Here's what it takes...

Disclaimer:

Use at your own risk. I'm not a finance pro, and don't have enough jingling money in my beggar cup to invest in investigating all these claims. Although you're more than welcome to contribute.

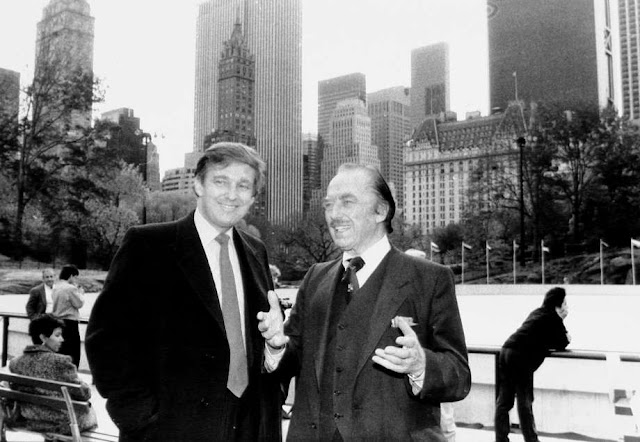

No one can guarantee you'll get rich like Trump. But I can tell you how someone like Trump got rich, even though he isn't 1,000 times smarter and doesn't have 24,000 hours in a day.

If you have 115 IQ, you're smart enough to do anything you want. Anything above 120 is surplus, says Warren Buffett. If you're going to be thinking, says Trump, you might as well be thinking big. Thinking big is faster, easier, more efficient, as Trump describes in Art of the Deal.

Thinking small puts barriers in your way, making it harder to succeed.

To control $700 billion dollars per year worth of media (which is worth 10 times more than you think), purchased at 4 to 6 times earnings, you'd need to raise about $3.5 trillion dollars, which takes $5 billion times 700 guys, or 50 billion times 70 guys, or $500 billion times 7 guys.

The last option is more likely, since finding 7 guys with faith is easier than finding 70. Jesus had 12, and one of them sold him out.

Trump (who doesn't work for money) only needs to know about one thing: Financing a business. If you can do that, it doesn't matter if 9 out of 10 businesses fail. We've reduced all of business to one competency: Borrowing the money.

That's it. Nothing else. Everything else you can buy. EVERYTHING else.

If 9 businesses in a row fail, the tenth, if successful, will more than pay for all the other failures. Funny. Seems like something they'd teach you in school, but they don't.

When Robert Kiyosake tried out this theory, his third business succeeded, (which is pretty common... the third restaurant in Manhattan has a 95% chance of success, but most people quit long before opening their 3rd business) and could have easily paid for more than 100 failures.

Now he teaches the Dream Team method. (See below.)

The known options in financing a movement, or a media platform, up to a billion dollars for your first deal.

#1 - Vendor Financing. The Julius Streicher method. By the time his printer really started pressing him for the money, he was on to the next printer. Early on, this allowed Streicher to finance the biggest expense of mass media, even when all else failed. (Stiffing vendors is not recommended.)

#2 - New Crowdfunding SEC rules. A hot topic, lately, but less useful than you'd think compared to other options. New rules have pros and cons. It's hard work for small money you'll need to repay. And outsourcing the hard work is problematic, making this one of the worst available options.

That's why it's popular. Because you're always going to be pushed to waste years of your life, just to end up broke and indebted on the other side.

But it's possible to raise $800k per year in rare circumstances. Seems like a lot, but it's not. You'll need to raise 3 to 5 times more than you think you need, and wait between rounds of funding, even leveraging IP as collateral with asset-based lenders.

Training time: As little as one weekend

Execution time: About 1 year per round of funding.

#3 - Dream Team Method. Up to one billion in one year or less.

Get an instant track record by joint venture with a retired pro & other key team members. Their credibility makes it possible. Peter Diamandis calls this method crossing the line of super-credibility.

"Perception is reality", says a man who helped students raise fifty billion dollars.

The mechanics are great. And fairly straightforward. But they're nothing without the right mindset and discipline.

If you have a karate black belt and a military background, and you don't care whether you see your family and friends much for a year or ten, you might have the discipline required to succeed big in big money, high-level acquisitions with your Dream Team.

You've got to be willing to risk it all to play in the big leagues. Not that you'll lose it all. Probably won't, if you're willing to risk what you've got, it means you mean business. Which we do.

You must be willing to have integrity, passionately communicate the big promise of a great opportunity and take on equally big responsibilities to fulfill on them no matter what, be willing to travel, work with top team players with big egos, be extremely generous or don't bother, be tight-lipped, and get your own ego completely out of the way. (All of which is in the gospel, BTW.)

If/when you go public, expect to be pushed out, and fast. So make sure you and your team get paid well, and paid upfront, or you might not get paid at all.

The hamster-wheel of never-ending fund-raising from financial institutions (not just banks) is not for everyone. Knowledge of business and finance is helpful, but oddly enough, not necessary. A modicum of faith is 100% necessary. Like it says in the gospel.

Jesus would have made an excellent Fortune 500 executive, as it turns out. But gave it up and was poor so that you could be rich, exactly as it states in scripture, or else none would survive.

Biggest first deal: $1.5 billion acquisition, generating 49 million dollars in first-year revenues.

That's right. BILLION. See source material.

By far the best known option, but it's a little-known one. See "Your First $100 Million" by Dan Pena. 30+ hours of free seminars on his website to help screw your head on straight.

WARNING: After taking this course, you won't have any more excuses.

Your cowardice and sloth WILL be exposed, and the source of all your failure will be revealed: YOU.

The dream team method is often (but not always) intended for acquisitions, consolidating an industry and then taking it public. The Andrew Carnegie method still works. Other exit strategies are available.

Education required: About 2 weeks, if you do nothing else but study your ass off. Which you should. Be sure to repay your debts so that you can borrow billions more to profitably spread the gospel like a pro and make disciples by the millions.

If Jesus Christ himself wrote a business course, this would be it. Cheat sheet here.

Execution time: 6 to 12 months or more, 2 financial presentations per week.

#4 - LBO - Leveraged Buyouts. If a company isn't already over-leveraged, its assets can sometimes be used as collateral to supply the down payment through traditional financing.

Training time: About 2 weeks

Execution time: As little as 6 months.

#5 - LBO 2 - And/or the existing owner is kept on, offered paper or equity (debt or shares) and cash flow financing lends based on a multiple of the profits. This supports sufficient capitalization to acquire the firm.

Training time: As little as 2 weeks.

Issues: Taking a company public virtually guarantees you lose control of the company. If you want to maintain control, you'd use a strategy like Warren Buffett used.

He eventually targeted under-valued companies with surplus cash on hand, and raised enough capital from silent partners to buy controlling interest.

This included insurance companies. Suppose it takes $5M to control $10M worth of assets. With that control, you direct your $10M company to invest its $10M in equity or cash to buy controlling interest in an undervalued company going for $20M and so on.

This concentrated millions, and eventually billions of dollars of control in the hands of one man at the head of a privately held company sitting as the majority shareholder of a chain of companies, with tremendous power all the way along the chain, able to clear out the board and management, if necessary, and install one loyal to his plan.

If optimizing for control, this is the way to proceed. A great companion to the dream team method. They're not mutually exclusive.

Learning time: As much as several years

Full Execution time: Decades

Of course, in the old days, if someone wanted you to sell your company, they'd simply send Murder, Inc. to make sure you did.

This makes the blockchain/crypto revolution very interesting. Gangsters or no gangsters, you can't sell a company that isn't really yours, especially if nobody really knows who controls it, that you have it, or where your "money" is coming from or going.

#6 - ICO Initial Coin Offering

Whether it's ever going to be legal or illegal or not, it's being done and basically can't be stopped, short of a worldwide EMP burst that erases the last 1,000 years of technological progress.

Learning time: No earthly idea. But definitely less than 5 years, and probably a lot less than one.

Execution time: Ask someone who knows. Less than 6 years. Less than 2 years. Crypto hasn't been around that long. ICOs are even newer.

Most suitable for the latest tech investments in blockchain, but theoretically possible to "go public" to raise a few bucks for a pizza parlor or ice cream shop. Legally? Ehhh. That's not my area. Nobody really knows yet. But it seems like something they'd try to regulate very quickly if it catches on.

Then again, they tried to regulate the Pirate Bay and peer-to-peer file sharing in general. About 20 years after Napster of SWAT team raids, server farm confiscations making hardly a dent in the functionality to the end user. So good luck with all that.

And be sure to let me know when you've shut down the bootleg tape & CD trade in Bangladesh and China. Or the illicit narcotics trade in maximum security prisons.

Bonus Method #7: Grow through sales.

Grant Cardone recommends starting by growing through sales, and grew 4 companies by smiling and dialing.

Though he eventually, when pursuing a billion dollars, admitted to using financing to grow his future to the next level.

Because it's not hard to raise money. Not nearly as hard as you've been told.

If you don't have good credit, or a track record of success, you can buy someone who does. This is called a Joint Venture, and it's done all the time. With persistence, you'll find someone.

Rule #1: Never use your own money. Use OPM.

Comments

Post a Comment